Pakistan Refinery Limited (PSX:PRL) is a hydro skimming refinery designed to process imported and local crude oil, located on the coastal belt of Karachi, Pakistan. It was incorporated in Pakistan as a public limited company in 1960. The refinery’s current capacity stands approximately at 50,000 barrels per day of crude oil into petroleum products, such as furnace oil, high speed diesel, kerosene oil, jet fuel and motor gasoline, among others. The refinery is operating at two locations; main processing facility is located at Korangi Creek with supporting crude berthing and storage facility at Keamari.

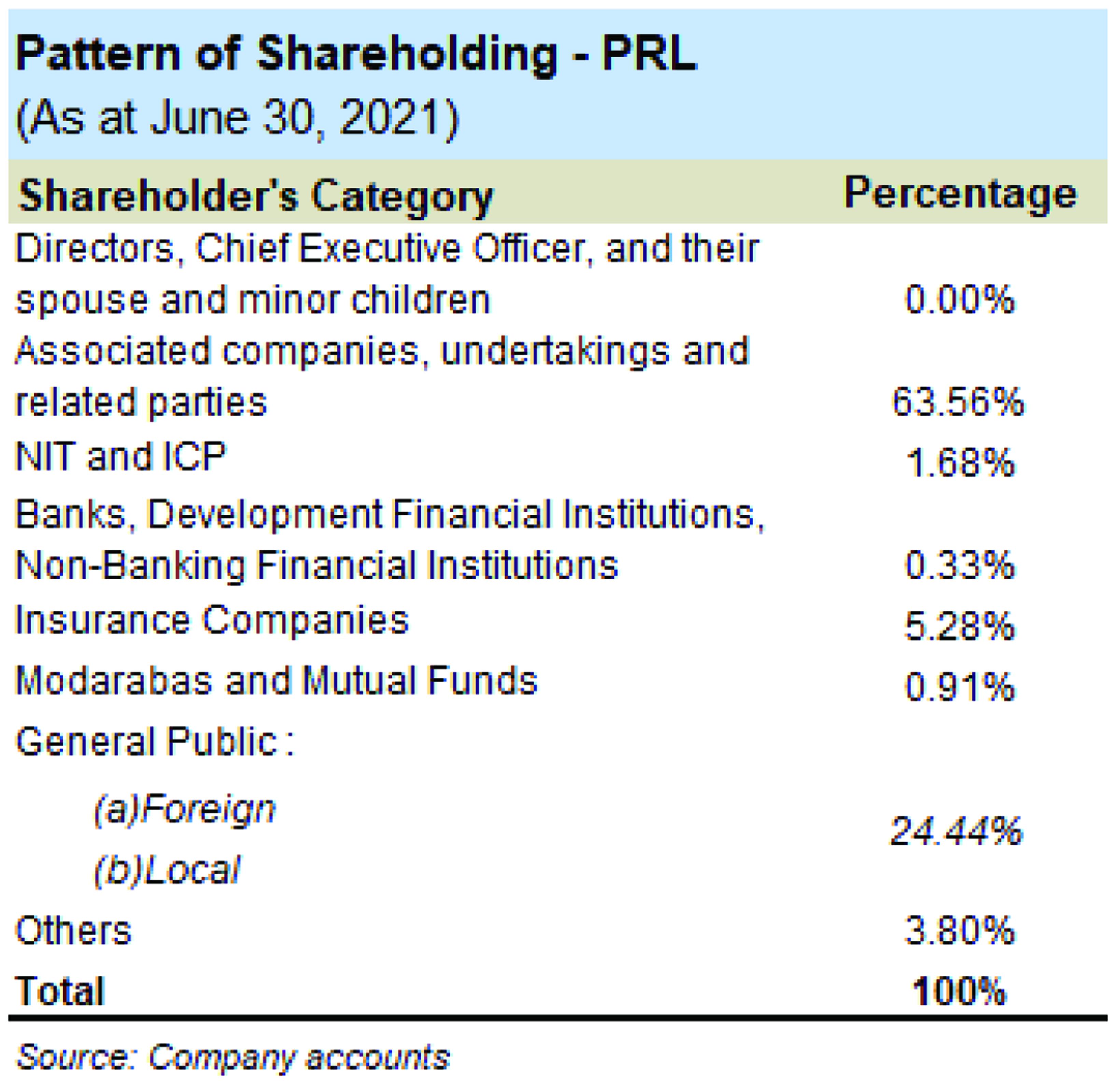

Shareholding at PRL

Shares of PRL are largely held by associated companies and related parties, and these include oil marketing companies. Pakistan State Oil (PSO) is the parent company of PRL and hold majority of the 63.5 percent held by the associated companies. General public that includes foreign and local shareholders hold over 24 percent of PRL’s share; the breakdown of the two is not given in the published accounts.

PRL Past Performance

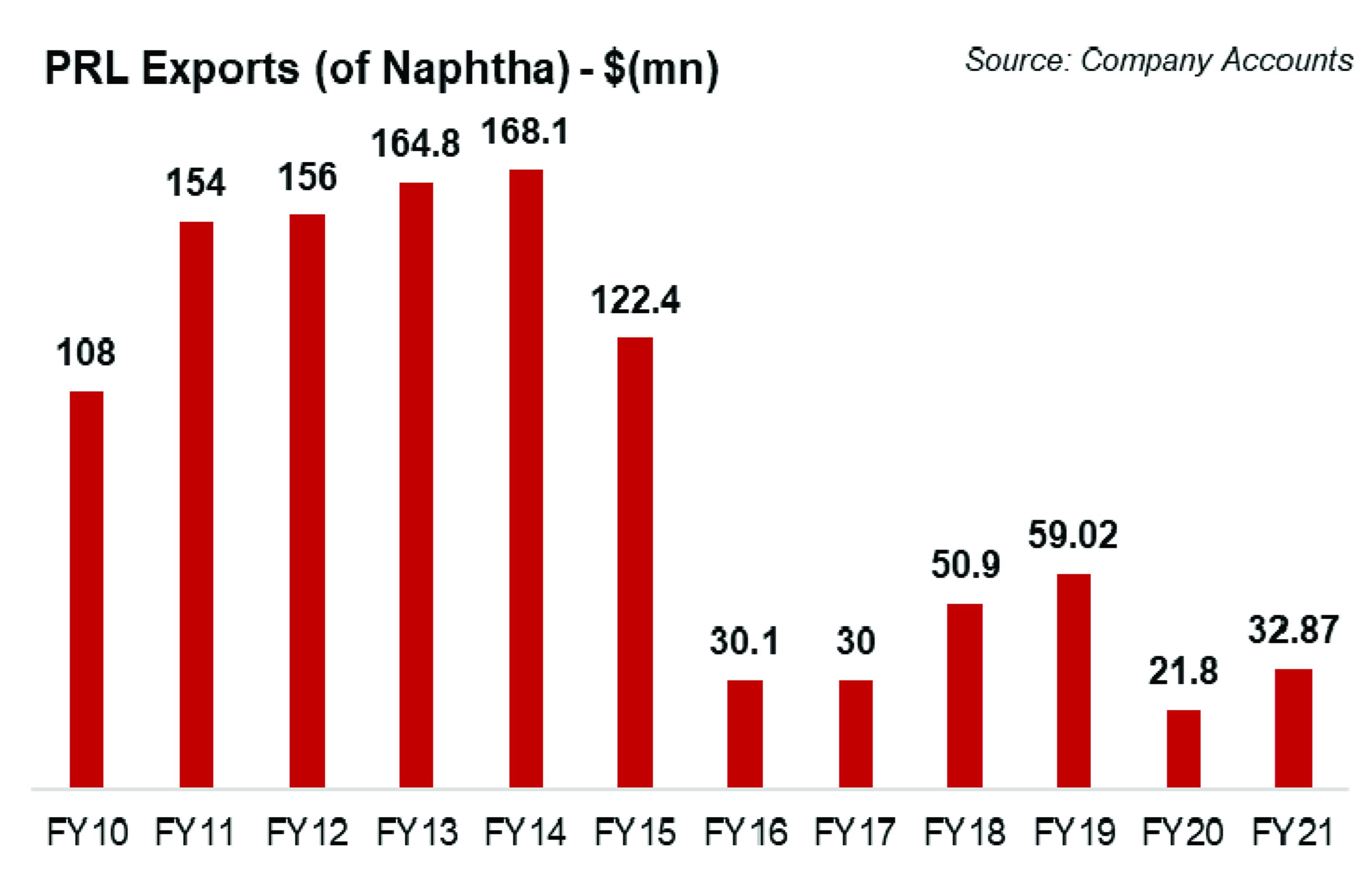

Refineries have had a roller coaster ride in Pakistan primarily because of the age old technology but also the squeeze in refining margins and the credit crunch in the energy sector in the country. In FY15, the refinery segment continued to grapple with issues mentioned above along with sharp decline in crude oil and product prices. This resulted in heavy inventory losses; and PRL saw a 36 percent year-on-year decrease in its topline along with increased finance cost that resulted in after-tax losses. This aggravated the negative equity situation of the firm. However, in FY15 the board of directors announced a right issue to meet the capex and financial requirements of its projects; and PRL commissioned the isomerization plant to convert low-value naphtha into gasoline (petrol), which doubled its petrol production.

In FY16, PRL’s earnings turned positive due to healthy gross refinery margins (GRMs) and the doubling of production of motor gasoline given the full year operation of the new isomerization unit. This was despite the fact that despite that there was a fall in the topline due to lower oil prices. The right-issue in FY15 and the firm’s commissioning Isomerization plant played a key role in reducing the firm’s reliance on bank borrowing and increasing operational liquidity.

In FY17, PRL saw its profits improve by more than three times, which also brought some reduction to the negative equity. However, during the year, the refinery faced the deactivation of the catalyst of the isomerization plant, which reduced the firm’s petrol production.

FY18 was again a slow year for PRL as its profit after tax halved despite a healthy growth of 32 percent in the company’s revenues. However, the company overcame the negative equity situation. Refining margins remained depressed during the year, which put pressure on gross profitability. Higher exchange losses due to currency depreciation and pressure on refinery operation due to decline in furnace oil demand also affected the refinery’s performance in FY18. Also, the catalyst of isomerization plant could not be operated at full capacity, which resulted in squeeze in petrol production.

In FY19, the refinery posted shocking decline in earnings again due to decline in the petrol prices, depressed refining margins and steep devaluation of currency locally. As a result the company incurred a loss of Rs5.82 billion in FY19 as compared to profit of Rs504 million in FY18. However, during the year, the company approved the Refinery Upgrade Project to meet the regulatory requirement of EURO II compliant HSD. In the same year. PSOacquired 84 million shares from Shell Petroleum Company Limited, UK, which increased its shareholding in the company to 52.68 percent, making PSO the parent company of PRL.

FY20 was a year of pandemic where demand for petroleum products was along with crashing oil prices. This meant heavy inventory losses. And PRL’s earnings were adversely affected again. During the year, PRL acquired additional Class B shares from Shell Petroleum Company Limited, UK (Shell) and Chevron Global Energy Inc. (Chevron), which increased the shareholding of the parent company (PSO). PRL incurred additional loss from the downward adjustment in HSD prices as the company could not install Diesel Hydrodesulphurisation Unit (DHDS) to produce EURO II compliant HSD in time.

FY21 was a recovery year. Growth in revenues for PRL in FY21 emanated from the FY21 last quarter’s topline, where revenues climbed by 80 percent year-on-year, taking overall topline growth to 2 percent for FY21. As for the improvement in profitability, it was due to better product mix that tilted towards diesel and petrol; also, the exchange gains and change in pricing policy to fortnightly from monthly helped the PRL turn losses into profits. Exchange gains stemmed from the change in pricing mechanism for petroleum products. Moderate growth in expenses and increase in other income further supported the operating margins, while decline in finance cost due to lower interest rates during the period lifted net margins in FY21.

PRL in FY22 and beyond

PRL’s earning in 1HFY22 were seen going in the negative territory again due to higher realized crude oil prices. During the period, the global oil industry entered a crisis like situation due to the Russia – Ukraine war. However, the third quarter of FY22 showed immense improvement. Where revenues were seen growing by 90 percent year-on-year. Overall, in 9MFY22, revenuesgrew by 72 percent. The company ensured uninterrupted supply of crude and was able to take advantage of healthy re¬fining margins that resulted in pro¬fit after taxgrowth of over 700 percent in 9MFY22. This was also despite the company incurring exchange loss of around Rs2 billion during the nine months period ended March 31, 2022.

PRL’s recent performance has lifted hopes significantly for FY22 overall profitability. Right after the 9M period, the company also appointed an international consultant to undertake Front End Engineering Design (FEED) work of the upgrade project and has also appointed a consortium of ¬financial institutions for local ¬financing requirements of the project.